However, investors are cautious due to Palantir's high valuation, currently at 240 times adjusted earnings, which reflects a volatile investment landscape.

Palantir Technologies has emerged as a leading performer in the S&P 500, showcasing a remarkable 20% increase in stock price in early 2025 following strong fourth-quarter financial results.

The company reported a 43% increase in its customer base, reaching 711, alongside a 36% rise in sales to $828 million and a 75% surge in non-GAAP earnings to $0.14 per diluted share.

The average target price for Palantir's stock has increased to $81 per share, although concerns about its high valuation persist.

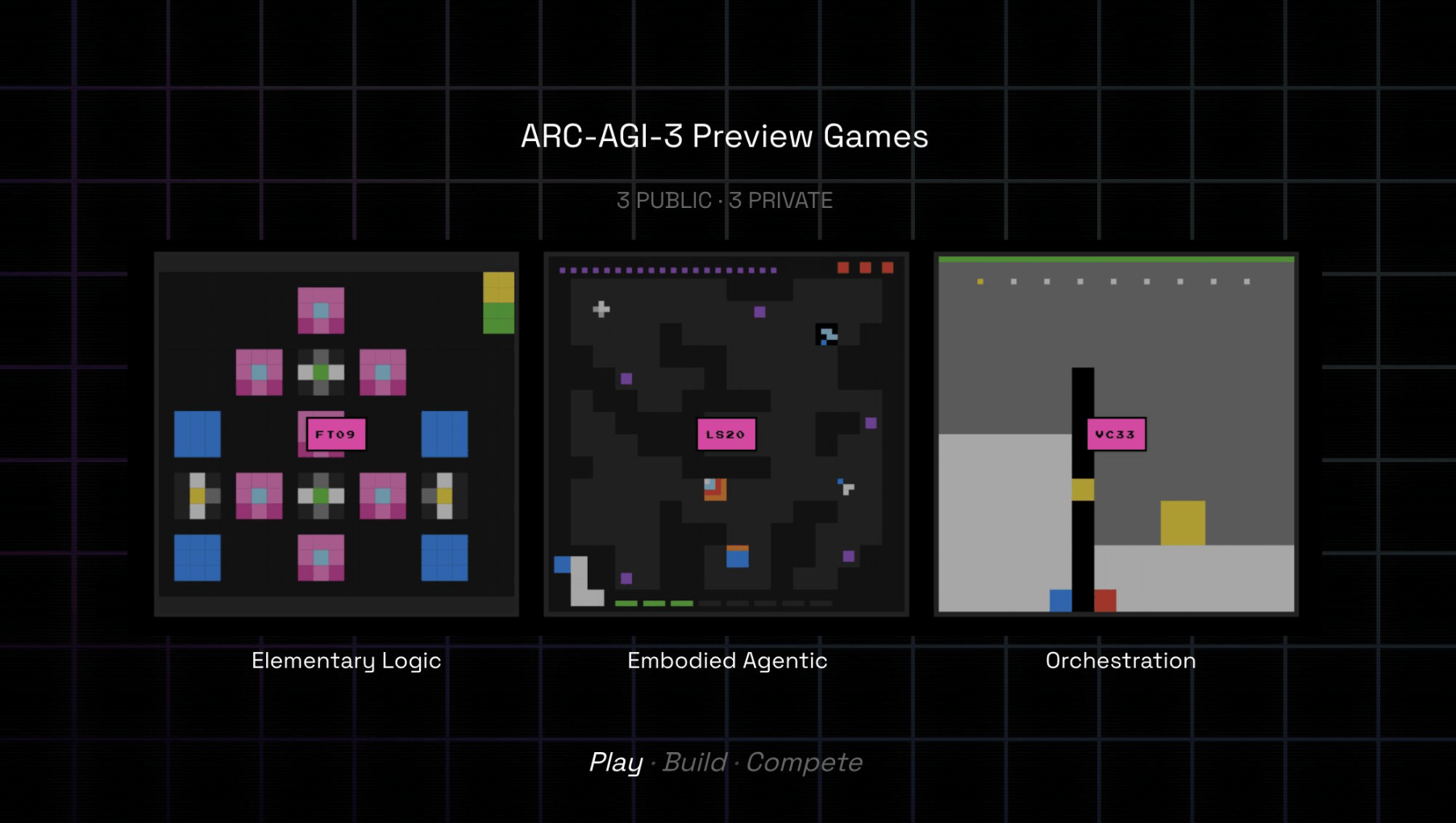

In 2023, Palantir launched its AI platform, AIP, which integrates large language models to enhance user interaction with its data analytics tools, Foundry and Gotham.

These flagship products enable clients to analyze complex datasets and develop machine learning models, positioning Palantir as a market leader in data analytics.

Palantir has been recognized by IDC as a leader in decision intelligence software and has received high rankings from Forrester Research for its AI/ML platforms.

As the AI software market is projected to grow to $153 billion by 2028, Palantir is well-positioned to compete with major players like Microsoft and Google.

Despite these concerns, analyst Dan Ives predicts that Palantir could achieve a market capitalization of $1 trillion within the next two to three years, indicating a potential upside of 335%.

Following the earnings announcement, Palantir's stock rose over 20%, boosting its market valuation to approximately $230 billion.

The company's consistent performance, exceeding Wall Street earnings expectations for six consecutive quarters, has led analysts to reassess its growth potential.

However, as an AI provider, Palantir faces scrutiny regarding its ethical implications and sustainability practices, highlighting the need for responsible AI usage.