Following the announcement of the investment, Meta's stock initially dipped in premarket trading but later rebounded by 1.7% when the market opened, reflecting positive analyst sentiment.

Zuckerberg acknowledged the risk of overspending in the AI sector but argued that substantial investment is crucial to avoid falling behind in this transformative technology.

Despite challenges, Meta reported a 21% year-over-year revenue increase in Q4 2024, highlighting strong ad spending and user growth across its platforms.

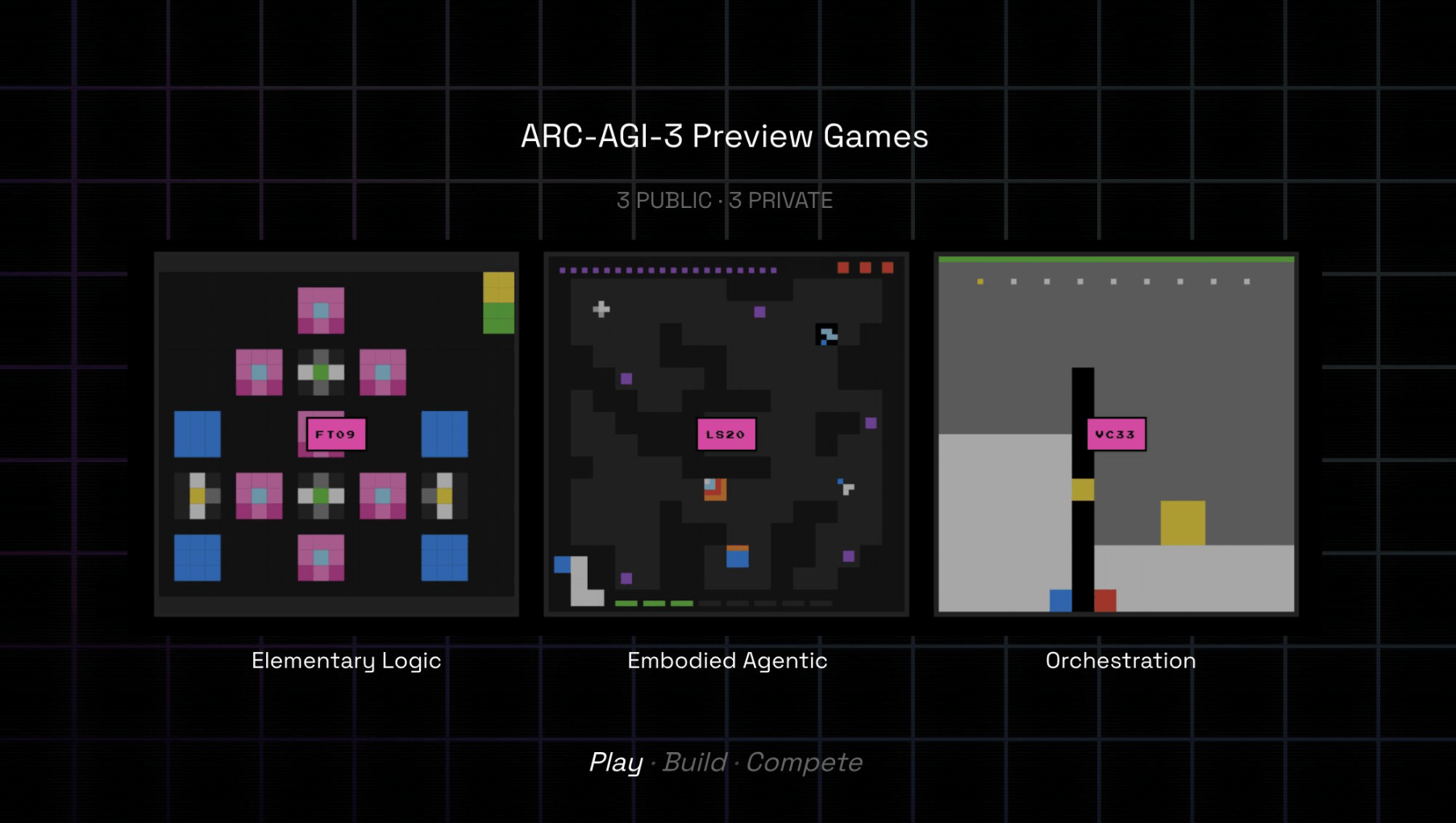

The emergence of DeepSeek, a Chinese startup that has developed competitive AI models at significantly lower costs, has sparked market fluctuations and raised concerns about U.S. tech firms potentially overspending.

DeepSeek's R1 large language model, which is open-source and allows user modifications, poses a competitive threat to Meta's proprietary models, potentially reshaping the AI landscape.

Concerns about DeepSeek's models diminishing the demand for Nvidia's GPUs led to a significant drop in Nvidia's stock, which fell nearly 20% recently.

As the U.S. AI industry transitions towards AI processing, DeepSeek's innovations in pre-training foundation models are gaining traction.

Meta Platforms CEO Mark Zuckerberg has announced a substantial investment plan of $60 billion to $65 billion in artificial intelligence for 2025.

He emphasized that Meta's extensive user base requires a strong AI infrastructure to maintain a competitive edge in the industry.

Zuckerberg noted that the ongoing training of Llama 4, particularly its mini version, is progressing well and is expected to set new benchmarks in open-source AI.

Despite the ambitious plans, analysts have raised concerns that this heavy investment could strain Meta's profitability, especially given past costly ventures like the metaverse.

Zuckerberg acknowledged DeepSeek as a new competitor but stated it is not an immediate threat, emphasizing the ongoing importance of GPUs for AI tasks.